Tax rate changes – A helping hand from eatPOS

Tax rate changes – A helping hand from eatPOS

With the government announcement stated by Mr.Sunak, VAT for hospitality and the entertainment industry will change from 20% to 5% (for many items).

To keep our customers up to speed below is a reminder of how you can change tax rates on your menus & products.

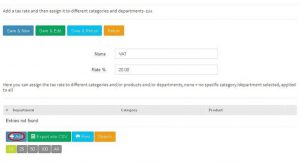

Setting up Tax rates is a simple process, you have the ability to create a tax rate and add it to a certain department, category or item. Firstly, go to Financial settings->Tax rates and mappings and click Add, the name would be VAT and the rate would be 5% in this case.

Then click Save and Edit. From here there will be another Add option which will need to be clicked so that you can set the tax rate to a specific area. In this example below we have assigned tax mappings to the Deep squid within the Main Course Category.

For more guides and useful tips please visit the helpdesk link at the top of your back office dashboard.